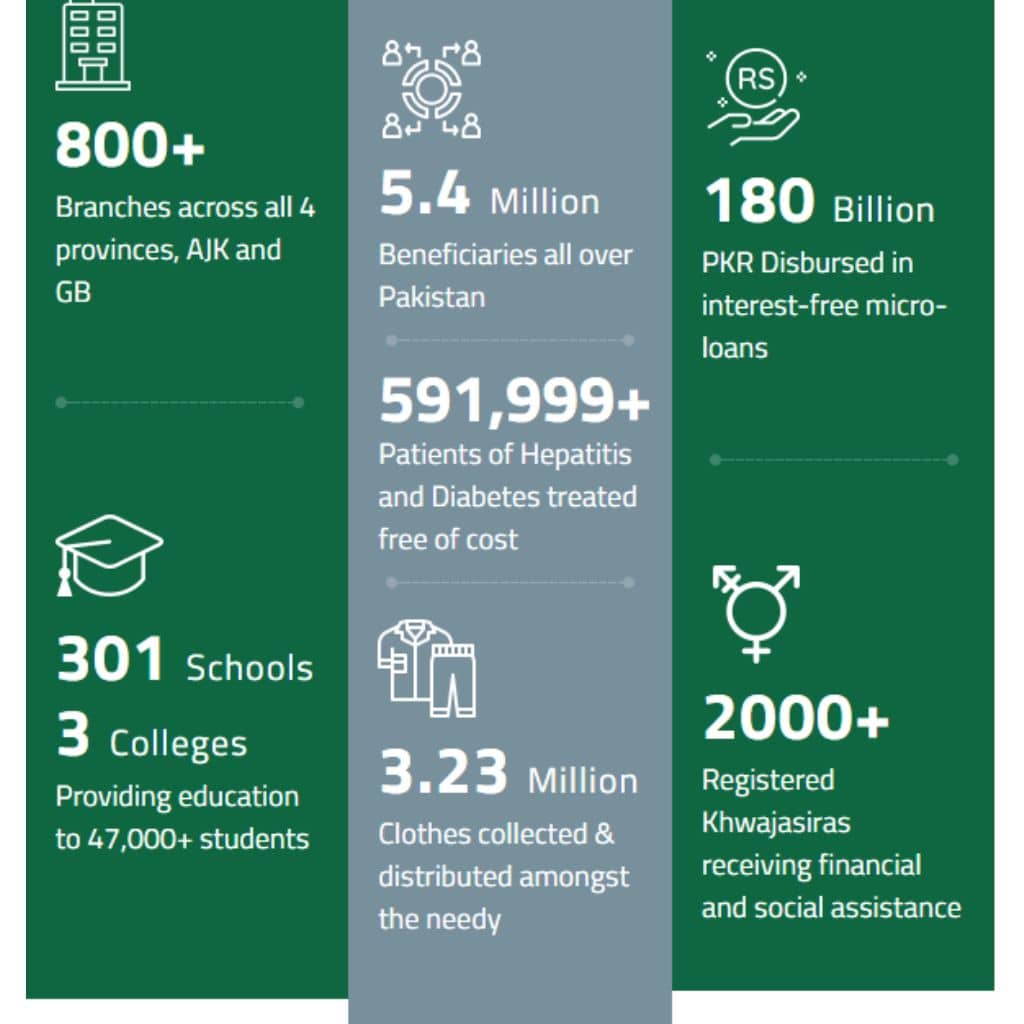

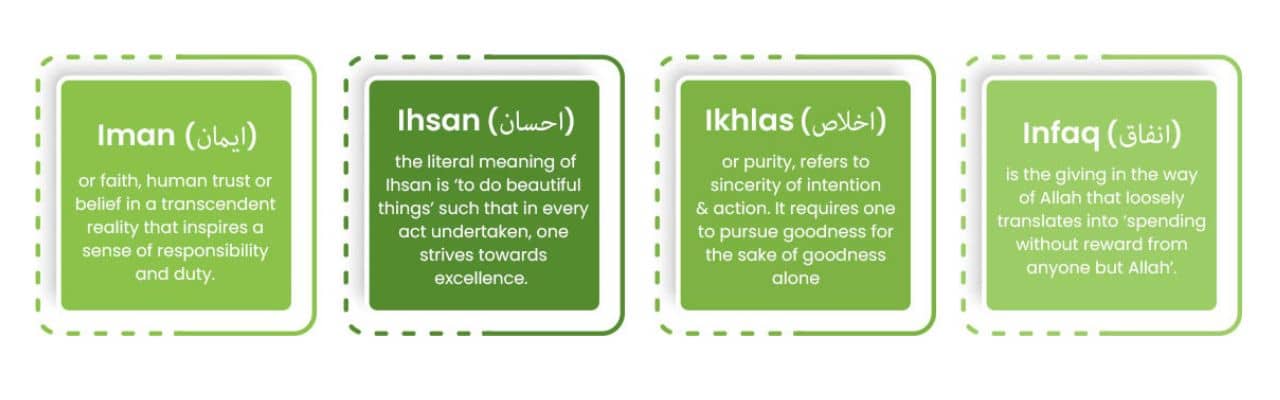

The Akhuwat Foundation helps poor people in Pakistan. Dr. Amjad Saqib started it in 2001, and it has become a large microfinance institution. Akhuwat promotes kindness, unity, and community support, inspired by the early Islamic concept of brotherhood. The foundation provides interest-free microloans to help people start or grow small businesses, making them self-reliant. Akhuwat’s microfinance model is special because it focuses on empathy and community rather than profit. This approach allows anyone, regardless of their background, to get financial help. The foundation works in different areas of Pakistan, supporting both cities and rural communities. Besides loans, they also offer business training and mentorship to help borrowers improve their skills and grow their businesses. Akhuwat is known for its innovative approach and has received praise from many organizations. It serves as a model for other small loan organizations worldwide because of its commitment to transparency and effectiveness. By promoting sharing and mutual support, the Akhuwat Foundation is making a big difference in Pakistan, helping create a fairer and wealthier society.

Akhuwat Foundation has changed microfinance in Pakistan by providing interest-free loans to those in need. Their goal is to help people financially without adding stress. These loans support individuals and families with money problems, helping them start businesses and achieve financial stability. To apply for a loan, go to any Akhuwat branch and complete an application. The staff will check your finances and needs to ensure the loan benefits you and promotes economic growth. Akhuwat offers different loans for various purposes, including business, education, marriage, and emergencies. Business loans help entrepreneurs start or grow small businesses. Educational loans assist low-income students in attending college. Marriage loans cover wedding costs, while emergency loans offer quick help during crises like natural disasters or medical issues. Akhuwat’s loan program involves the community. Borrowers pay back loans in small amounts, which encourages responsibility. This program also motivates borrowers to become donors later, giving back to their communities. Akhuwat has helped many people escape poverty, gain independence, and improve their lives. By offering interest-free loans and promoting community support, Akhuwat has made a big difference in Pakistan’s development.

اخوت قرض کے لیے درخواست دینا آسان اور قابل رسائی ہے، جو ضرورت مند لوگوں کی مدد کے لیے فاؤنڈیشن کی لگن کو ظاہر کرتا ہے۔ اس عمل میں اس بات کو یقینی بنانے کے اقدامات شامل ہیں کہ قرضے مستحق امیدواروں تک جائیں جنہیں سب سے زیادہ فائدہ ہوگا۔ اخوت قرض کے لیے درخواست دینے کے طریقہ کے بارے میں تفصیلی گائیڈ یہ ہے:

مرحلہ 1: ابتدائی انکوائری۔

شروع کرنے کے لیے، قریب ترین اخوت برانچ پر جائیں۔ ان کی پورے پاکستان میں بہت سی شاخیں ہیں، لہذا مختلف علاقوں کے لوگوں کے لیے ان کی خدمات کا استعمال کرنا آسان ہے۔ برانچ میں، قرضوں کی اقسام کے بارے میں پوچھیں اور درخواست دینے کے لیے تفصیلات حاصل کریں۔

مرحلہ 2: اہلیت کی جانچ

درخواست فارم بھرنے سے پہلے، یہ یقینی بنانا ضروری ہے کہ آپ اہلیت کے معیار پر پورا اترتے ہیں۔ اخوت فاؤنڈیشن کو عام طور پر درخواست دہندگان کی ضرورت ہوتی ہے:

پاکستانی شہری۔

مالی امداد کی حقیقی ضرورت ہے۔

ایک قابل عمل کاروباری منصوبہ بنائیں (کاروباری قرضوں کے لیے)۔

قرض کی ادائیگی کا عزم ظاہر کریں۔

مرحلہ 3: دستاویزاتاپنی درخواست کی حمایت کے لیے ضروری دستاویزات تیار کریں۔ ان دستاویزات میں عام طور پر شامل ہیں:

قومی شناختی کارڈ (CNIC) کاپی۔

رہائش کا ثبوت۔

کاروباری منصوبہ یا تعلیمی ریکارڈ، قرض کی قسم پر منحصر ہے۔

آمدنی کی تصدیق کے دستاویزات۔

مرحلہ 4: درخواست فارم

اخوت قرض کی درخواست فارم کو درست طریقے سے پُر کریں، تمام مطلوبہ معلومات فراہم کریں۔ یہ فارم برانچ سے حاصل کیا جا سکتا ہے یا ہماری ویب سائٹ سے ڈاؤن لوڈ کیا جا سکتا ہے۔ اس بات کو یقینی بنائیں کہ آپ قرض کو مؤثر طریقے سے استعمال کرنے کے لیے اپنی مالی ضروریات اور منصوبوں کی تفصیل دیتے ہیں۔

مرحلہ 5: جمع کرانے اور ابتدائی جائزہ

اخوت برانچ میں درخواست فارم اور مطلوبہ دستاویزات جمع کروائیں۔ یہ یقینی بنانے کے لیے عملہ اس کا جائزہ لے گا کہ آپ نے تمام ضروری معلومات اور دستاویزات فراہم کر دی ہیں۔

مرحلہ 6: فیلڈ کی تصدیق

اخوت کے فیلڈ افسران آپ کے گھر یا کاروبار کا دورہ کریں گے تاکہ یہ معلوم کریں کہ آیا آپ قرض کے لیے اہل ہیں یا نہیں۔ اس سے اخوت کو آپ کی صورتحال کے بارے میں مزید جاننے اور یہ فیصلہ کرنے میں مدد ملتی ہے کہ آیا آپ قرض حاصل کر سکتے ہیں۔

مرحلہ 7: قرض کی منظوری

آپ کی درخواست کی تصدیق کرنے کے بعد، قرض کی کمیٹی اس کا جائزہ لے گی۔ منظور ہونے پر، آپ کو قرض کی رقم، شرائط اور شرائط کے بارے میں مطلع کیا جائے گا۔ اخوت شفافیت کو اہمیت دیتا ہے اور آپ کے لیے قرض کے معاہدے کے تمام حصوں کو واضح کرے گا۔

مرحلہ 8: تقسیم

آپ کے شرائط سے اتفاق کرنے کے بعد، ہم آپ کو جلد قرض دے دیں گے۔ اخوت اس بات کو یقینی بناتا ہے کہ عمل تیز اور موثر ہے تاکہ آپ بغیر کسی تاخیر کے رقم حاصل کر سکیں۔

مرحلہ 9: استعمال اور نگرانی

قرض حاصل کرنے کے بعد، رقم کو اس کے مطلوبہ مقصد کے لیے استعمال کرنا ضروری ہے۔ اخوت فاؤنڈیشن چیک کر سکتی ہے کہ قرض کیسے استعمال ہوتا ہے اور ضرورت پڑنے پر مدد کی پیشکش کر سکتا ہے۔ اس سے یہ یقینی بنانے میں مدد ملتی ہے کہ قرض کا استعمال کاروبار شروع کرنے، تعلیم کے لیے ادائیگی، یا ہنگامی حالات سے نمٹنے جیسے کاموں کے لیے ہوتا ہے۔

مرحلہ 10: ادائیگی

قرض لینے والے مالی دباؤ کے بغیر چھوٹی، آسان اقساط میں ادائیگی کر سکتے ہیں۔ اخوت کا سود سے پاک ماڈل آپ کو صرف اصل رقم ادا کرنے دیتا ہے، اعتماد اور کمیونٹی سپورٹ کی تعمیر۔

Akhuwat Foundation provides different types of loans to help people and communities in Pakistan. These loans are made to solve financial problems and help borrowers improve their lives. Here is a detailed overview of the different loan types provided by the Akhuwat Foundation:

Akhuwat’s microfinance program provides business loans to help entrepreneurs start or grow small businesses. This creates jobs and boosts local economies. The main features of Akhuwat business loans are:

Akhuwat helps students from low-income families achieve their academic goals by providing educational loans. These loans pay for tuition, books, and other school costs. The main features are:

Marriage loans assist families in covering wedding costs. Akhuwat provides these loans to help families with their wedding expenses. Akhuwat offers:

Emergency loans provide fast assistance during crises like natural disasters, medical emergencies, or sudden personal issues. Key points include:

Akhuwat offers housing loans to help people and families enhance their homes. These loans can be used to build new houses or repair existing ones. Key features include:

Health loans help cover medical costs like treatments, surgeries, and medications. They allow people to access needed healthcare without financial stress. Key features include:

The Akhuwat Foundation is a non-profit organization in Pakistan dedicated to providing interest-free loans to the underprivileged to help them start or expand their businesses and improve their living conditions.

Akhuwat offers interest-free loans primarily for micro-enterprises, small businesses, education, health care, and housing purposes, focusing on empowering individuals and communities.

Usually, people with low income who can’t use regular banks because they don’t have collateral or good credit can apply. The requirements for eligibility may change depending on the type of loan.

Applicants can apply by visiting an Akhuwat office, attending a community meeting, or through our website, where they can find application forms and details on the submission process.

Basic documentation includes a valid ID card, proof of residence, and a business plan or detailed description of how the loan will be utilized, depending on the loan type.

The loan amount varies based on the loan type and the applicant’s needs and repayment capacity, which are assessed during the application process.

Repayment terms are flexible and designed to accommodate the borrower’s financial situation, typically structured in monthly installments.

Yes, Akhuwat actively encourages women to apply for loans, offering various programs specifically designed to support women entrepreneurs and individuals.

No, Akhuwat doesn’t need traditional collateral. It focuses on trust and community support.

Akhuwat tries to finish the review and give out money quickly, usually within a few weeks, but the time can change.

Yes, Akhuwat provides loans for educational purposes, supporting individuals seeking to further their studies or vocational training.

Akhuwat helps borrowers who are having trouble repaying their loans by adjusting the repayment schedule to make it easier for them.

Akhuwat operates across Pakistan, with numerous branches and field offices in both urban and rural areas.

Akhuwat ensures borrowers pay back loans by staying connected with the community, reminding them of their responsibility, and checking in regularly.

Yes, Borrowers who have paid back their loans can apply for more loans. They might get approved for higher amounts based on how well they repaid their previous loans.

Akhuwat’s funding comes from a combination of individual donations, community contributions, and partnerships with local and international organizations.

Yes, Akhuwat provides training and support services to help loan recipients improve their business skills and increase the success of their ventures.

You can help by donating, volunteering, or starting an Akhuwat chapter in your community. Visit the Akhuwat website for more information.

Need help? Our team is just a message away